Assistance in Obtaining Energy Grants & Rebates

Opportunities to improve efficiency and reduce energy-related costs often requires investment in new equipment, technology, or controls. Identifying funding available to your business and providing estimates of project payback are key components of our technical reports.

Our clients are often eligible to apply for funding to assist with improvement efforts. However, we know that some funding opportunities are time sensitive and have specific eligibility requirements. Our advisors can help you determine which grants are the right fit for your company and project needs.

Don’t be intimidated by grant and rebate applications and the required paperwork. We’re here to help! Our team of technical advisors can:

- determine if your project qualifies for funding

- assist with audit/assessment to gather pertinent data for application

- answer questions throughout the process

- assist with completing the application

- make connections to other funding programs

Contact us for the most up-to-date information on funding for which your organization may qualify.

Small Business Advantage Grant (SBAG)

Program Overview

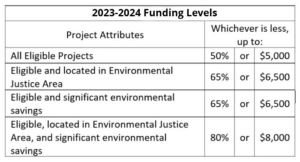

SBAG provides grant awards determined by project eligibility, project location (relating to Environmental Justice areas), and environmental impact. Learn more.

Eligibility

- Pennsylvania-based businesses with 100 or fewer full-time employees are eligible.

- Applicants must be for-profit entities, located in Pennsylvania, and registered with the Pennsylvania Department of State.

- Eligible applications are considered on a first-come, first-served basis, and must save the small business a minimum of $500 and at least 20% annually in energy or waste-related costs (Natural Resource Protection projects are exempt).

Read how we helped a metal fabrication company secure over $85,000 in grant funding

Rural Energy for America Program (REAP)

Applications can be submitted any time throughout the year but will be evaluated and awarded after various deadlines.

Program Overview

REAP provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses to purchase or install renewable energy systems, or make energy efficiency improvements. Learn more.

Eligibility & Requirements

- Businesses cannot be in a city or town with a population of greater than 50,000 inhabitants or in the urbanized area of that city or town. See if your business address is eligible here.

- Agricultural producers with at least 50% of gross income coming from agricultural operation and small businesses in eligible rural areas are eligible. Agricultural producers and small businesses must have no outstanding delinquent federal taxes, debt, judgment, or debarment.

- Energy efficiency projects require an energy audit or assessment completed by an independent third-party.

Read how we helped Innovative Sintered Metals secure a $13,000 REAP grant

Act 129 Rebates

PA utilities have energy incentive programs under Pennsylvania Act 129 that provide rebates for the purchase of new equipment for lighting systems, HVAC, motors, and a variety of other equipment. The final rebate amount is determined for each project individually but generally ranges from $0.025/kWh to $0.05/kWh of energy saved. Pre-approval is recommended for all projects prior to commencing construction.